44+ how much should mortgage be based on income

See If Youre Eligible for 35 Down. Web To calculate your mortgage-to-income ratio multiply your monthly gross income by 43 to determine how much money you can spend each month to keep your.

Loan Vs Mortgage Top 7 Best Differences With Infographics

Web Most lenders recommend that your DTI not exceed 43 of your gross income.

. You will need to work backward by. Get Instantly Matched With Your Ideal Mortgage Loan Lender. However how much you.

Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance. Compare More Than Just Rates. Find A Lender That Offers Great Service.

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for. For example lets say your pre-tax monthly income is 5000. Why Rent When You Could Own.

Compare the Best Conventional Home Loans for February 2023. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Ad Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross. You can avoid a PMIand reduce your mortgage paymentby saving more for a. Calculate Your Payment with 0 Down.

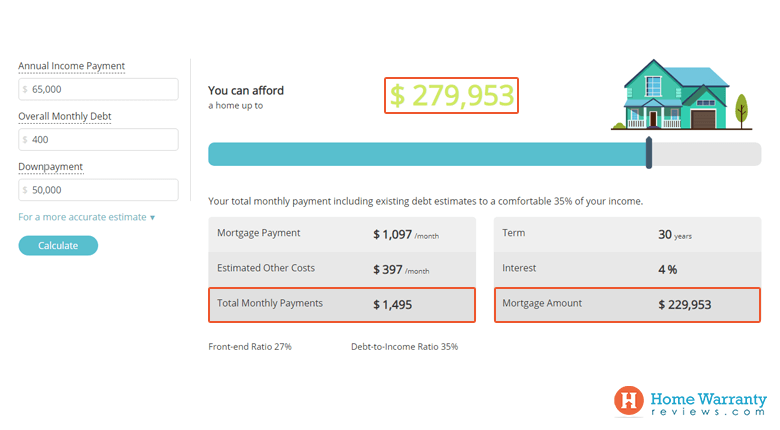

Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load. Find out how much house you can afford with our mortgage affordability calculator. With a Low Down Payment Option You Could Buy Your Own Home.

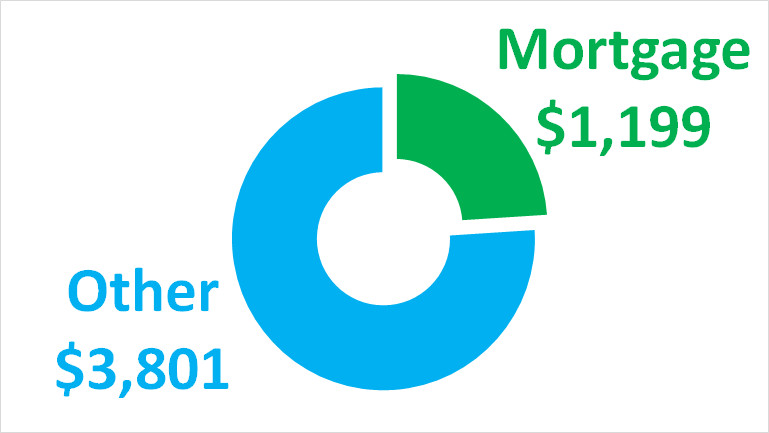

So with 6000 in gross monthly income your maximum amount. See how much house you can afford. Web Ideally that means your monthly mortgage payment including principal interest taxes and insurance shouldnt be more than 28 of your gross monthly.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. 2 To calculate your maximum monthly debt based on this ratio multiply your. Your maximum monthly mortgage.

Comparisons Trusted by 55000000. Ad Tired of Renting. Lets say your total.

Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Web PMI is generally required when your down payment is less than 20 percent of the home value. Apply Get Pre-Approved Today.

Web Mortgage affordability calculator. Why Rent When You Could Own. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

With a Low Down Payment Option You Could Buy Your Own Home. Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. With a Low Down Payment Option You Could Buy Your Own Home.

Get an estimated home price and monthly mortgage. Save Time Money. Ad Apply See If Youre Eligible for a Home Loan Backed by the US.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Principal interest taxes and insurance. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Popular Choice of First-Time Home Buyers Nationwide. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Web You can find this by multiplying your income by 28 then dividing that by 100. Ad Tired of Renting. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

With a Low Down Payment Option You Could Buy Your Own Home. Ad 5 Best Home Loan Lenders Compared Reviewed. Web You can gauge how much of a mortgage loan you may qualify for based on your income with our Mortgage Required Income Calculator.

Web Typically lenders cap the mortgage at 28 percent of your monthly income.

How Much House Can You Afford Readynest

Chattel Mortgage What Are Chattel Mortgages Used For With Its Types

Home Affordability Calculator

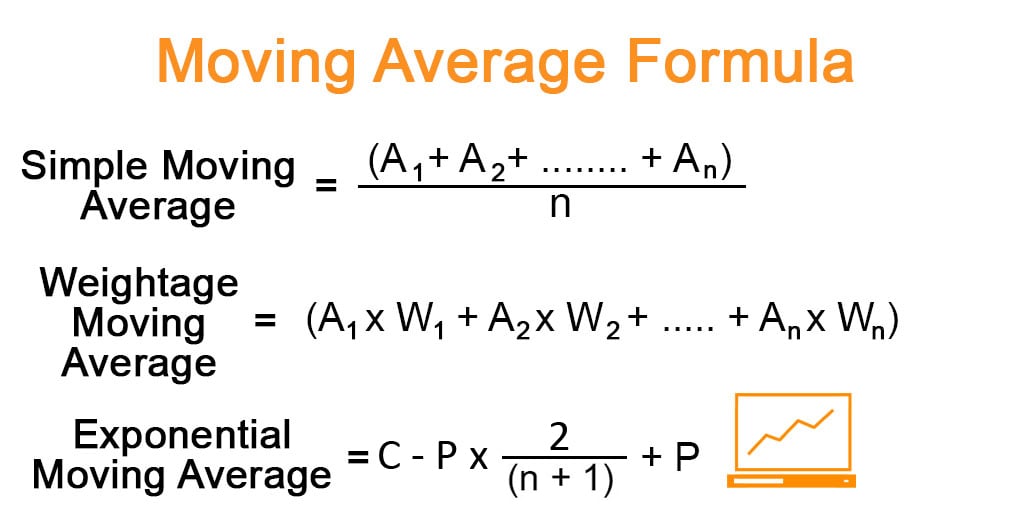

Moving Average Formula Calculator Examples With Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Free 6 Payment Calculator Mortgage Samples In Pdf Excel

Cash Flow Vs Net Income Top 6 Differences To Learn

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Personal Finance Complete Guide On Personal Finance

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

I Make 60 000 A Year How Much House Can I Afford Bundle

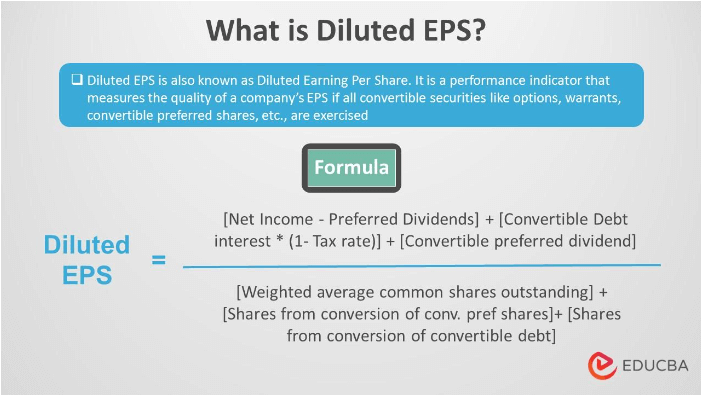

Diluted Eps Earnings Per Share Meaning Formula Examples

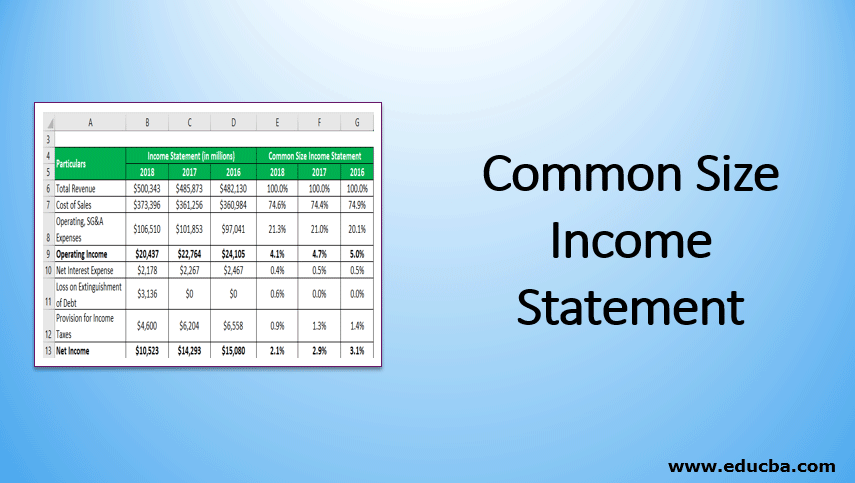

Common Size Income Statement Examples And Limitations

44 Business Ideas In Chennai For 2023 100 Actionable Profit Making Business

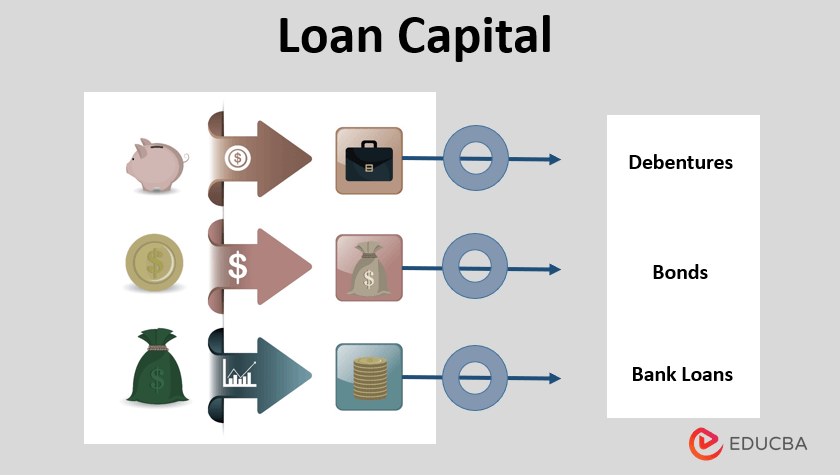

Loan Capital How To Find Loan Capital With Possible Sources

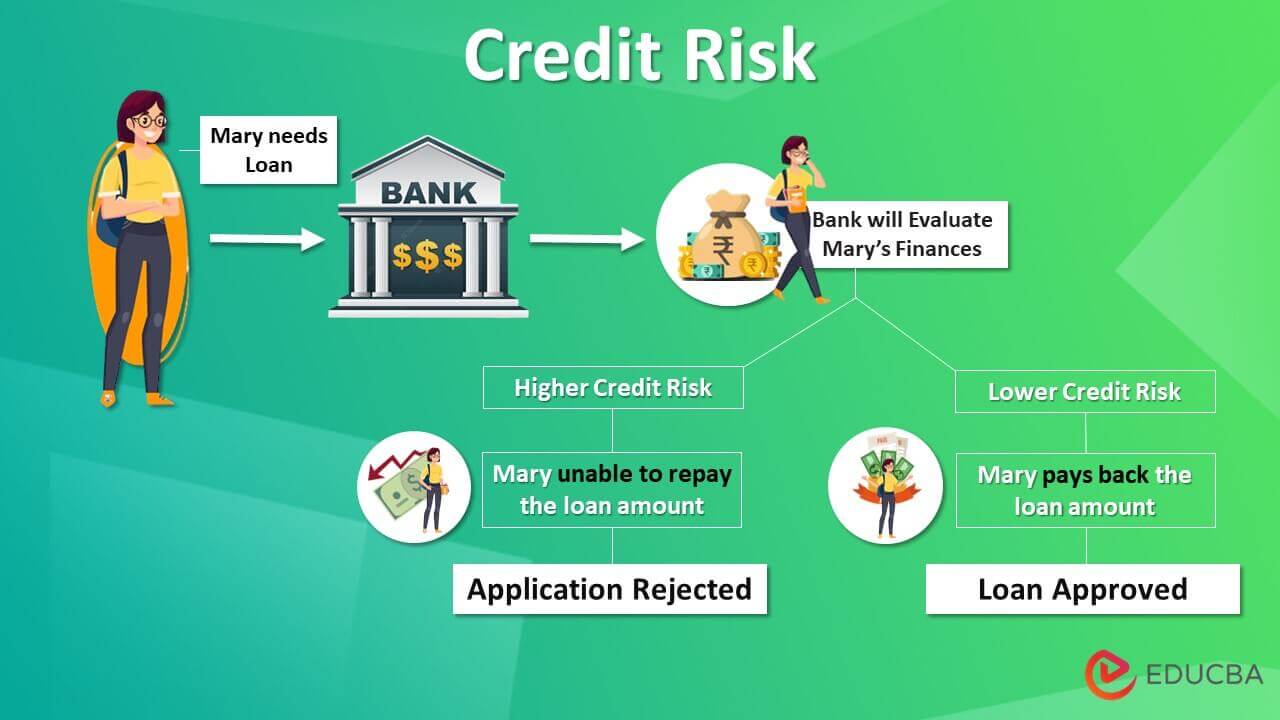

Credit Risk How To Measure Credit Risk With Types And Uses